Inflation is invariable in a growing economy like India. You can see this is in all fields. Health costs have spiralled a lot since the last decade. Coupled with the fact that people are falling sick more often, it becomes imperative to have adequate health insurance cover in place.

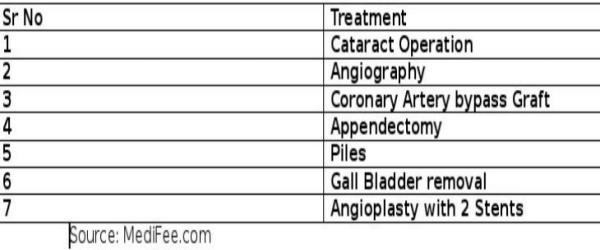

Let us do a quick comparison of costs of certain common medical surgical procedures to get a better understanding of the process.

The above table suggests that the costs of medical procedures have increased more than 100% on an average. Has our income generating capacity increased in a similar fashion? The answer is a definite ‘NO’. A majority of people will agree that health care inflation is a worrisome feature. What is the solution for this issue? The only possible solution in sight is to have adequate health insurance.

Health Insurance – How can it help you?

According to Apollo Munich, “a survey report suggests that nearly 95% of Indians are under-insured in terms of Health Insurance, with those above 45 in the highest risk group.” Health insurance will not protect you from diseases or prevent you from having surgeries. However, they can play a great role in helping you to tide over the financial crisis that you would face in case you have to incur a major surgery. They can save you the hospital bills, the cost of surgery, medicine, and pre as well as post-operative medical expenses. Is this not a viable solution? A majority of people will agree.

Health insurance costs

We have given you an indicative figure about the costs involved in certain common surgical procedures. This is excluding the cost you incur for various diagnostic tests before the surgery as well as the post-operative medical expenses. You should be factoring in these aspects when you sit down to calculate the health insurance cost of your entire family.

Your health insurance costs depend on various factors.

Your present age

Your present medical condition

The age of your spouse and children

Inflation in health costs

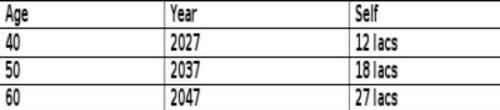

Let us have a simple example to understand things better. Consider the case of a 30-year-old individual with a health insurance policy of Rs 6.00 lacs today in 2017. We assume the normal inflation rate to be around 10%. With this background, this chart will provide the right kind of information. We reduce the rate of inflation to 5% for the subsequent period

This table shows you that your policy of Rs 6.00 lacs today increases to Rs 27 lacs by the time you reach 60 years of age. Considering the rate at which health costs are increasing, will this amount be enough? There are doubts, but they can certainly reduce your financial burden a great deal.

Importance of Adequate health cover:

No one can predict the future. It is better to be prepared to face the exigency. The premium will be negligible when compared to the insurance amount. Hence, it makes sense to invest a small amount every year to take care of your medical expenses in the future.

You can argue that there are chances you might never avail the insurance amount. Yes, it is possible. Under the circumstances, the amount of premium you pay every year is a loss. However, you never know. You might require a life-saving surgery in the future. At that time, this insurance cover will come handy.

Usually, the hospitals do not increase the rates on a yearly basis. Statistics show they do so in a lump sum manner of say 15-20% after 3 years. Thus, it would be prudent on your part to increase your health coverage gradually over the period to cover the cost of inflation.

Final thoughts:

Inflation is something we cannot avoid. It is in our best interests to account for the inflation factor when we take health insurance cover. The more cover you have the lesser the financial burden you have to endure in times of emergency.